There is a ton of advice on salaries, but none of it is one-size-fits-all.

How can you

determine a salary number that covers your expenses, allows you to save, and reflects your worth? How can you attach one number to all of that?

This question comes up all the time—and many other related questions come up alongside the salary question. Calculating a salary number for a new job will differ from

calculating the percentage of a raise to request. Then, what about a COLA salary increase, where you're factoring in the increase in cost of living?

We're not mathematicians, but every salary equation and each salary formula is a little different. In this article, we will share a good place to start. This three-step method can give you an idea of the salary you might require—and that's before you factor in your experience, achievements, and your industry.

The 3-Step Salary Equation

Before getting your calculators out, we want to share why we love this little math problem here quickly. When calculating this salary number, you'll create a number that covers your expenses, allows for saving, and plans for all those unexpected expenses that love to hit you up at once!

Step 1: Add Your Monthly Expenses

All of them. Pull up your monthly statements for the past six months and total everything up.

What's the average amount you spend each month? While you're doing this, it doesn't hurt to

take a look at your spending habits. Separate your expenses into three buckets: necessities, recurring bills/entertainment, and incidentals.

Necessities Include:

- Housing costs

- Utilities

- Insurance

- Transportation

- Groceries

- Debt + Loans

- Cellphone

- Emergency Fund + Savings

Recurring Bills Examples:

- Gym Membership

- Subscription Services

- Software

- Meal Deliveries

Incidentals Examples:

- Travel

- Birthday Gift

- Car Repair

- ER Visit

Some months cost more than others. We're looking at you, DECEMBER. That's why it's helpful to tally up your expenses over a few months. We recommend six months because it spans a few seasons, which helps give a clearer view of how much you actually spend without the crush of holidays or back-to-back family birthdays.

Got your number? Let's go on to step number two!

Step 2: Take Your Monthly Expenses + Double Them

After adding up your monthly expenses and finding a rough estimate of how much you spend each month, double that number. This number gives you a little breathing room to grow, pay off debt, and build your savings and emergency fund.

If you did look through six months of bills, we're sure you found some doozies that justify doubling this number. Remember that one Monday morning, when you cracked your molar in half on your first bit of Honey Bunches of Oats? This actually happened to our content director, and the emergency crown was not a fun expense to absorb.

Protect your future self. Double the number! But, that's not all.

Step 3: Add 20 Percent

Now that you have created the double cushion, what's one more pillow, so to speak?

Add the 20 percent to give yourself some negotiating power. In the worst-case scenario, your number is declined. This extra twenty percent gives some bargaining power and an opportunity for a still attractive counteroffer. Since none of us are strangers to the absolute awkwardness that salary negotiation can bring, this buffer also prevents us from "...or whatever you think"-ing ourselves at the most crucial moment.

Create your number, and be prepared to negotiate for it. Don't back down.

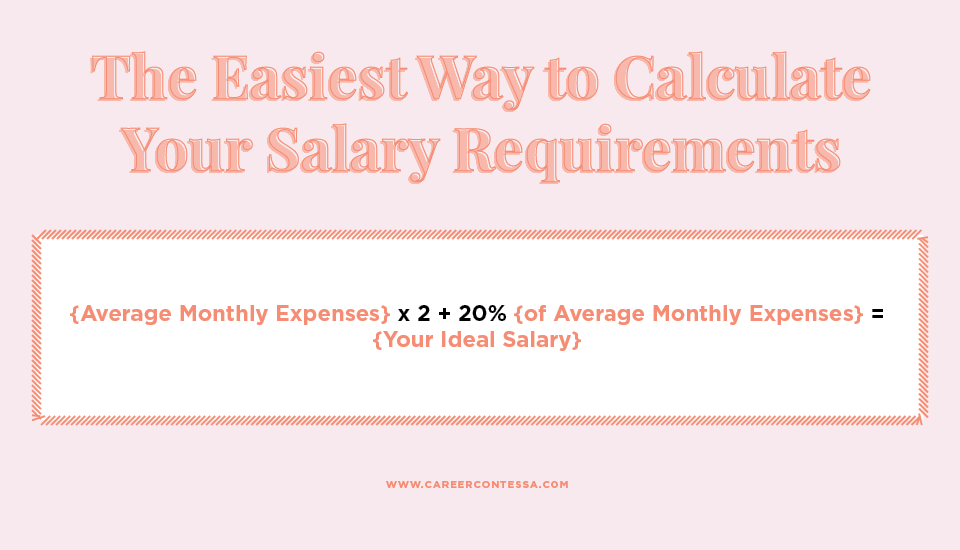

Without further ado, here's the little salary equation we promised:

{Average Monthly Expenses} x 2 + 20% {of Average Monthly Expenses} = {Your Ideal Salary}

Next Steps in Salary Research

Think of this number as your starter dough.

Just like any great breadmaker, you'll use it to ferment your salary asks in the future. In some cases, it might shrink down a little bit. In other cases, your starter dough number will morph into the most delicious boule at the job you've always wanted! Did we take the bread analogy far enough? Okay, fine.

Here are more salary resources to help you research your market rate, encourage salary transparency talks, and take a peek at thousands (literally, thousands) of real salaries.

How to Negotiate Your Raise

You've done most of the work already. Doing salary research and

really knowing your worth is truly the most time-consuming part of this process.

Now, you can confidently ask for what you know you deserve. The easiest way to do that is to set a meeting with your manager, and make the case using our 5-step negotiation process, which we call, "

The GIMME."

Because asking for a raise is hard—and we want to help.

- G: Give Background Info

- I: Introduce Why You’re Awesome

- M: Make Your Case Research-Based (This is where all that research comes in!)

- M: Make the Ask

- E: End with a Bang

By hitting each step as you talk, you’ll make a clear case for why you deserve more money, and you’ll provide your boss with a clear idea of how you're helping your team and your company reach the bottom line. It’s a perfect sell.