One sunny Saturday morning I rolled over in bed, stretched, and then thought to myself, “You know what sounds fun today? Creating a budget!”

I’m full of it, that never happened. Budgeting sucks. It’s boring, stressful, and is there ever a good time to do it? If there is, I haven’t discovered it yet.

Which is why, to make things easier on myself (and all of you), I’ve found the easiest budgeting philosophy out there. The one that takes almost no thought to set up or to keep going. The one to rule them all. Drumroll, please…

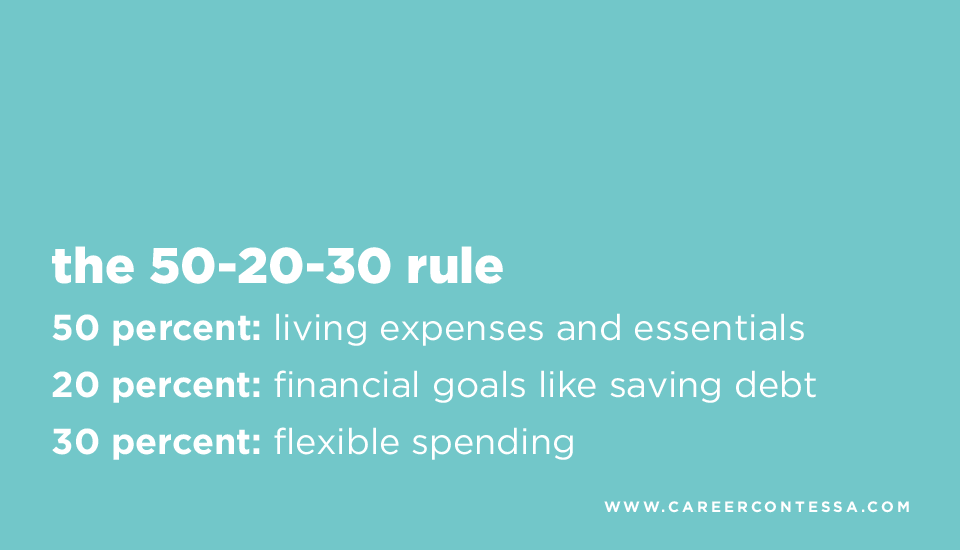

I present you with the 50-20-30 Rule!

WTF Is 50-20-30?

The

50-20-30 Rule organizes a budget around three simple spending categories that determine how you divvy up your income. Guess what those percentages are? Yep. 50%. 20%. 30%. Here's how they work:

- 50 percent covers living expenses and essentials such as rent, health care, groceries, transportation for work, etc.

- 20 percent goes towards financial goals like your savings, investments, paying down debt, student loans, or down payment on your first home

- 30 percent can be used for flexible spending, in other words, everything you want to buy but don’t necessarily need like dinners out, travel, or entertainment

Where Do I Start?

Before we get into the nitty-gritty, remember that your budget can (and should) allow for a certain amount of flexibility. Like a diet, you can’t expect perfection. Know that little slip-ups are going to happen!

Also, a disclaimer: you do not need to spend all of your allotted money in every category. If you find you have extra room in your living expenses, then add some of that money to the financial goals category (20%). And if you live in a big city where rent is steep, you may need to allot less to savings to cover your living expenses—which totally sucks, but it is what it is. See our point? Flexibility.

OK, back to the point. There are just three steps:

Step 1: Look at your pay stubs to determine exactly how much you bring home each month. Then split that money into the 50-20-30 categories.

Step 2: Write down your current spending habits. In other words, the things you pay for over the course of the month—whatever your expenses really look like when you’re not on a budget. And we mean everything including those bi-weekly matcha lattes.

Step 3: Divvy those habits into the three categories of essentials (50%), financial goals (20%), and flexible spending (30%). This is also a good time to see where you can cut things from your budget. Do you really need Netflix, Hulu, and HBO Go?

Why Does It Work?

The reason I love this form of budgeting is it keeps things simple and realistic. We’ve probably all read somewhere that you should save 50% of your salary, but that’s not always a realistic goal—especially if you're new to the workforce, have student loans, or are in debt.

You can still save a decent amount with this budget, but you also don’t have to deprive yourself. For me, the most useful part of this exercise was forcing myself to see how I spend my money. And looking at it according to only three main categories versus many smaller ones (à la Mint) made it clear to me what my financial priorities are (or should be)

Do I still hate budgeting? Absolutely. But this makes it much easier to suck it up and get it done.