Living paycheck to paycheck is a pain, but often a reality in your twenties.

When you do land the "real job," it's not just your bank account that changes. Here's how to shift your perspective as well. From being fresh out of college seeking work to supporting yourself with odds and ends jobs, many of us have experienced living paycheck to paycheck. So what happens when you finally do get the job that can support your costs and then some?

Once you land a livable wage, it’s easy to believe you will suddenly have a great bank account that requires little thought. But your first “real” job provides the perfect opportunity to form good money habits in order to create a lifestyle where you’re actually supporting yourself without breaking the bank.

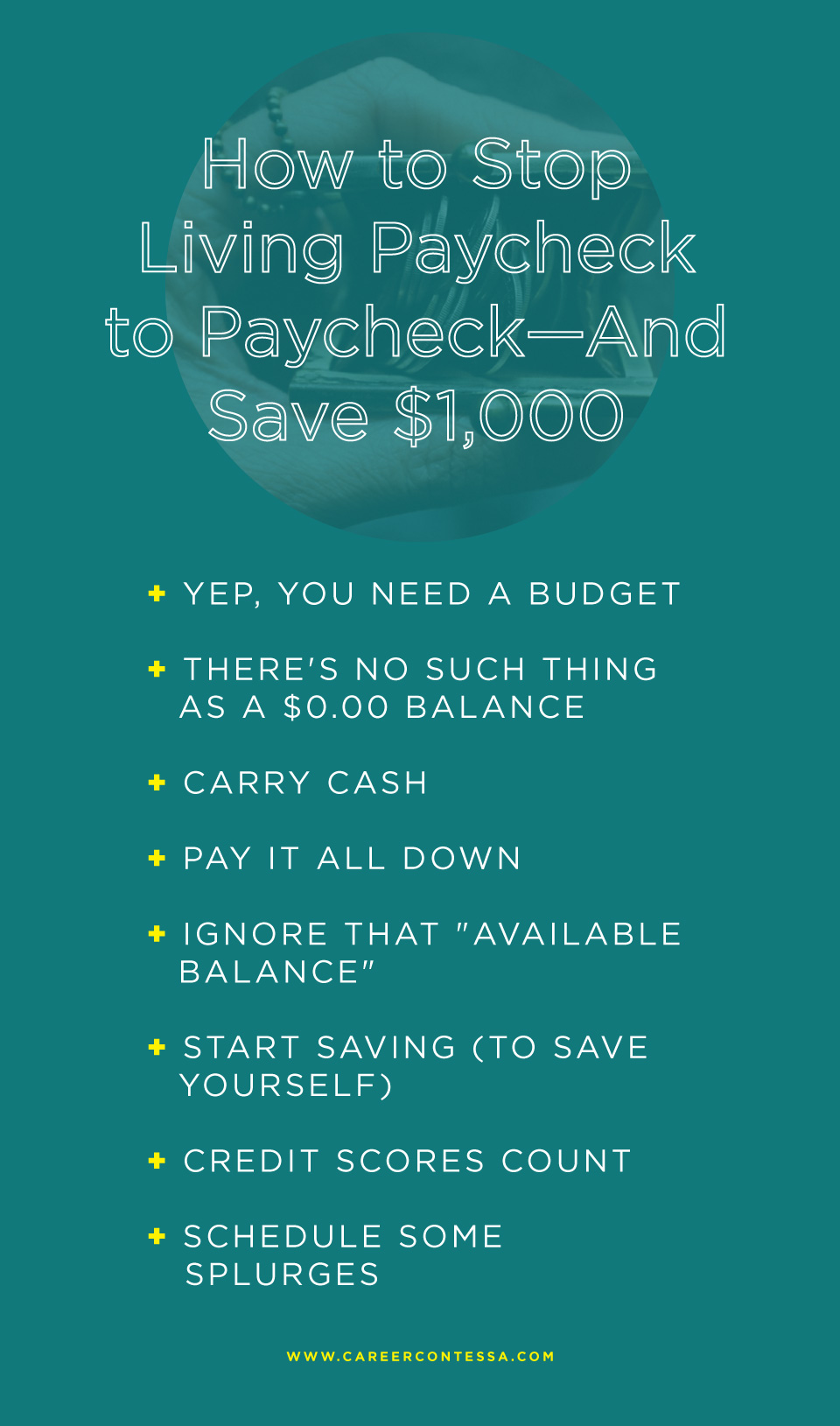

Yep, You Need a Budget

This is always the first piece of advice financial experts give, but for good reason:

a budget is vital to ensuring you use your money appropriately. When you live paycheck to paycheck, spending your money is relatively simple: you cover the bills at hand, then use whatever’s left to buy pasta and ramen, carefully avoiding overdrafts.

Once you’ve landed a job that pays beyond basic expenses, it’s harder to make the call on

where and when to spend your money. It’s tempting to go wild and buy the things you’ve denied yourself up until now, but before blowing your paycheck at Whole Foods, sit down and make a budget yourself. This will give you a clear visual of what you’re working with. The format doesn’t matter—create a classic Excel spreadsheet or use cool apps like

Mint.com—but try a few options to find whatever sticks best with your lifestyle.

There's No Such Thing as a $0.00 Balance

One of the hardest things to realize when you go from paycheck to paycheck to a livable wage is that you should have money in your account all the time.

With a living wage, you should never overdraw your account—in fact, you should never get close to zero. Just because you have money in the account doesn’t mean you can spend it all. Try to focus on accumulating a fair amount in your checking account before you start making impulse buys or other entertainment purchases. Set a “bare minimum” along with alerts from your bank so you never get too low.

Carry Cash

Debit cards can be a terrible addiction. While it’s easy to resort to swiping a card, many people don’t realize how much they’re spending on the little things (think: lattes five times a week). Get into the habit of carrying cash to avoid overspending. And for those who are a little too quick to use the card, stop carrying your debit card altogether and carry just the cash you’ve budgeted for the week.

Pay It All Down

After living paycheck to paycheck, most likely you’ve got a debt you need to pay off: student loans, a credit card, or maybe even a car. Start putting your extra cash towards paying these bills off sooner. Try to live off your former budget (or close to it—no one’s telling you to go back to the ramen days, sister), while channeling the remaining balance toward debt repayment. Minimum payments should only be a last resort option—the more you can chip away at your debt, the less you have to worry about.

Ignore That "Available Balance"

It’s easy to want to use a credit card when you are starting to finally make a sizable income—whether it's habit or because you believe you have the paycheck to support the purchase. If you already have credit cards, focus on trying to pay them off immediately. Credit cards are never worth the risk of increasing or continuing debt, especially when high-interest rates could end up costing more.

Start Saving (to Save Yourself)

For so many, saving money seems like a luxury, but it’s the smartest way to avoid going broke. Start by saving an emergency fund of around $1,000. Nothing will make you go broke quicker than a car repair that requires handing over your entire paycheck to fix the problem. Once you’ve got a basic emergency fund, it is always good to save up a few months’ worth of pay, anywhere from three to nine months depending on what you can afford. Additionally, don’t overlook saving for retirement. No matter if your job offers a 401(k) or if you have to open an IRA on your own, make sure to always invest in your future.

Credit Scores Count

Most likely if you are were living paycheck to paycheck, your credit is lackluster at best. Speak to a financial advisor or use online tools like credit checks (

Annual Credit Report is the federally-approved website) to plan and rebuild a credit score to match your impressive new income. In some cases, this might require opening a line of credit—but remember our warning about credit cards. Make sure you’re never spending more than you can afford to pay off each month.

Schedule Some Splurges

When you finally have money, it’s hard to trust it’s really there. But even as you set yourself up with a solid budget and start paying off debts, remember to

offer yourself a little fun money. Save up for a trip, put some aside for weekly dinner nights with friends, or go shopping every once and awhile. After all, if you finally have money to support yourself, you might as well enjoy it.